Financial transmission rights are no longer protected in California, creating substantial new risks for utilities and their ratepayers

For decades, electricity market participants in the West have been able to hedge against congestion costs. Now that is all changing.

Financial Transmission Rights (FTRs) are financial instruments used to hedge against congestion[1], but FTRs will no longer be fully protected once CAISO’s Extended Day-Ahead Market (EDAM) launches in 2026.

Unless fixed, the EDAM design could impose new, unhedged costs for utilities and their ratepayers, particularly across the region’s critical North-South transmission corridors.

This means the burden of managing congestion risk is shifting from contracts to forecasts. Market participants will increasingly depend on short-term operational visibility to stay ahead of risk—just as that risk is skyrocketing thanks to load growth, renewables, and extreme weather.

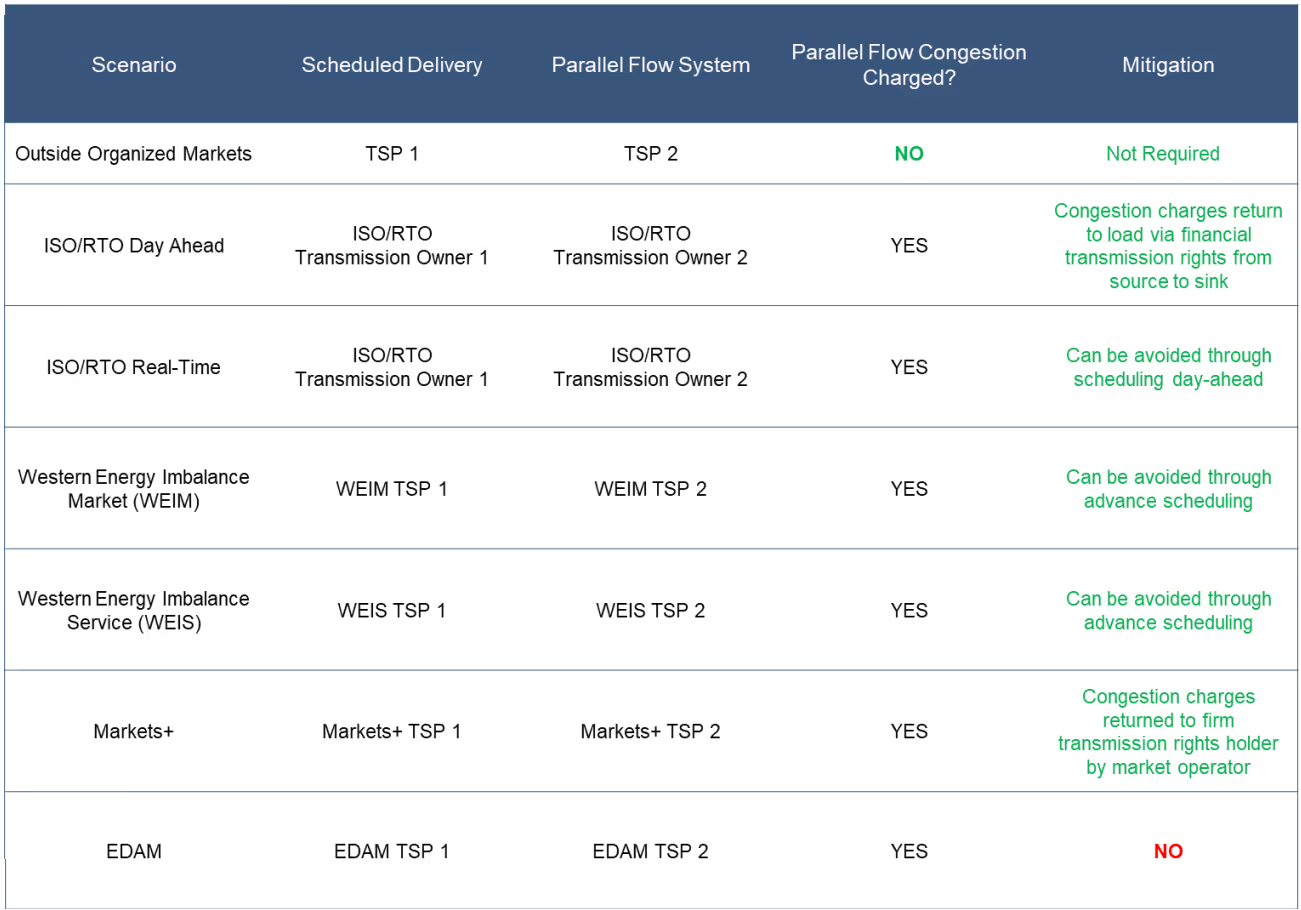

OATT and FTRs previously provided protection against congestion

Since 1996, the Open Access Transmission Tariff (OATT) has promoted competition by ensuring non-discriminatory access to transmission services in the western US. Before that, utilities that owned transmission lines could favor their own generation units.

Under OATT, customers can purchase firm transmission service, guaranteeing physical delivery of energy across the grid at a fixed price, regardless of congestion. This provides peace of mind for load-serving entities, rewarding those who invest in transmission infrastructure.

With the advent of CAISO’s market-based dispatch system, physical transmission rights no longer guarantee financial protection against congestion, so Financial Transmission Rights (FTRs) were created to preserve the economic hedge once provided by OATT-based firm service. FTRs give market participants a way to receive compensation for congestion costs between two points on the grid, acting as a reliable financial hedge even if actual power flows are rerouted by the market operator.

EDAM breaks the hedge

As of this writing, CAISO’s Extended Day-Ahead Market design does not fully support Financial Transmission Rights or Congestion Revenue Rights. CAISO acknowledges the need to develop similar instruments, but these are not expected to be in place at the time of launch.

The EDAM is designed to help utilities across the West trade electricity more efficiently, extending the benefits of day-ahead markets to regional actors outside of CAISO’s system. This is intended to improve grid reliability, reduce costs, and facilitate the expansion of renewables.

The EDAM optimization process attempts to respect existing firm transmission service, but if it finds a better solution, those rights may be curtailed without compensation. Moreover, those rights are no longer tradeable and cannot be reserved in advance.

The bottom line: existing OATT customers will lose protection against congestion, and new market entrants may have a difficult time securing predictable transmission paths at all.

All this is happening as congestion charges are increasing

These risks are not going away. In fact, congestion charges are likely to continue increasing, especially in the West where a high penetration of renewables is colliding with changing weather patterns and other factors.

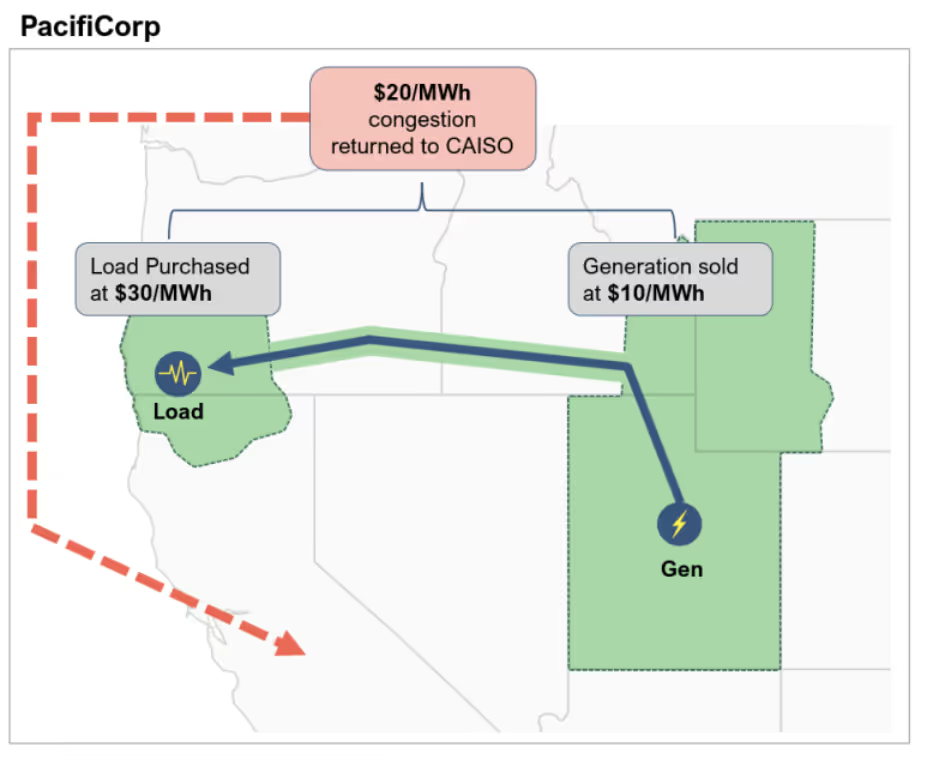

As solar installations increase across the Southwest, midday exports to northern systems like PacifiCorp and Idaho Power become more common. These deliveries often take paths that cross CAISO’s system, triggering CAISO congestion charges that will no longer be refunded.

So if PacifiCorp schedules a delivery that flows across a congested CAISO line, for example, PacifiCorp must pay CAISO for that even if it holds firm transmission rights elsewhere. Under FERC’s approved transitional fix, some of those congestion revenues are returned to PacifiCorp’s balancing authority, but not directly to the customer. This means PacifiCorp could face an unhedged congestion cost—a situation where it must pay for congestion without the financial protection normally provided by OATT’s firm transmission rights.

Similarly, large hydro-powered utilities in the Pacific Northwest commonly sell excess generation into CAISO during snowmelt, but changing weather patterns make this less predictable. Earlier snowmelt could mean more excess generation during the shoulder season when demand is already low, for example.

CAISO approved a transitional fix, but it’s not enough

In response to fairness concerns, CAISO approved a transitional fix in Jun 2025, but this is not a permanent solution. It partially allocates congestion revenues to neighboring regions, ensuring balancing authorities outside CAISO will receive some money to offset congestion charges. This was enough to keep the EDAM launch on track, but it provides little peace of mind for market participants.

A more comprehensive redesign is expected within 12 to 24 months of launch, and stakeholders will be watching closely to ensure it provides financial certainty for market players and restores alignment with OATT principles.* If it doesn’t, expect chaos on par with California’s famous water wars.[3]

Accurate forecasting is now more critical than ever

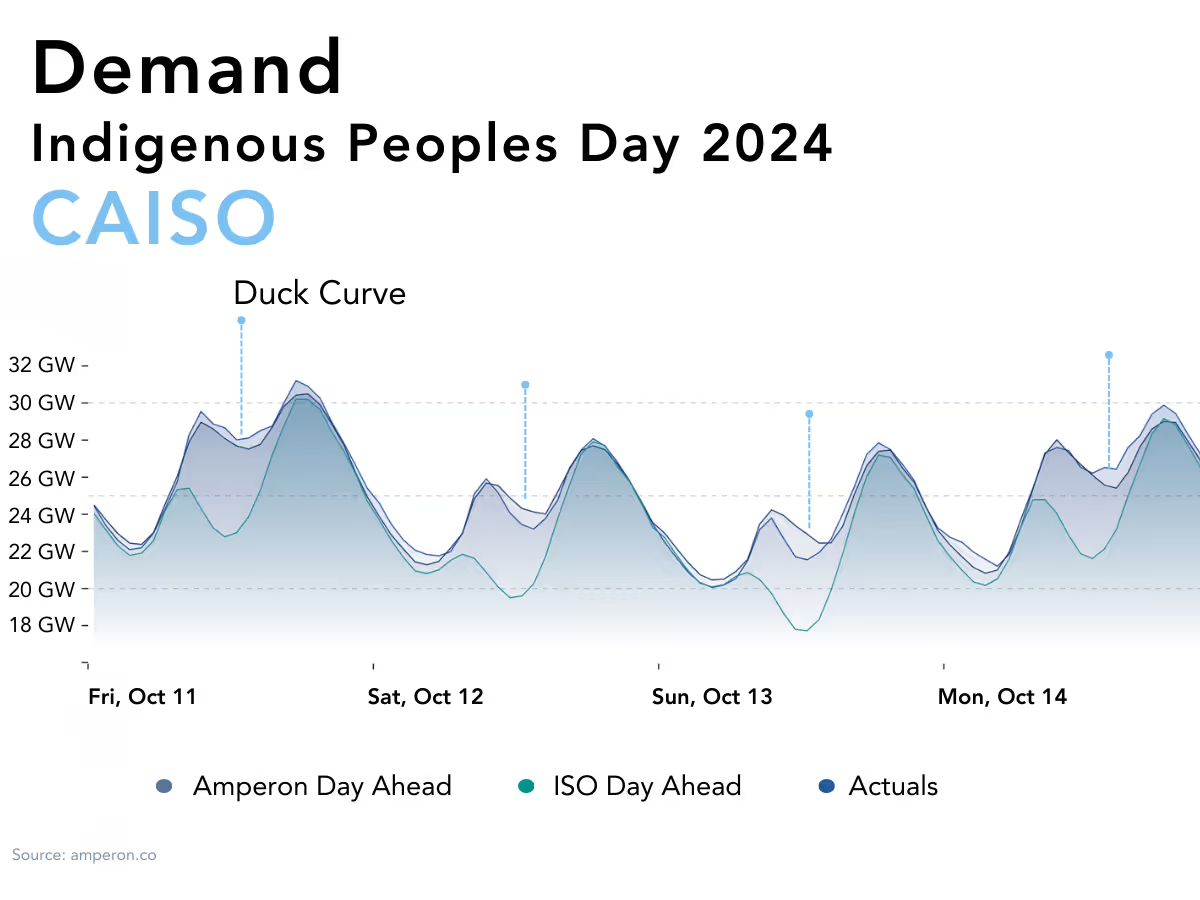

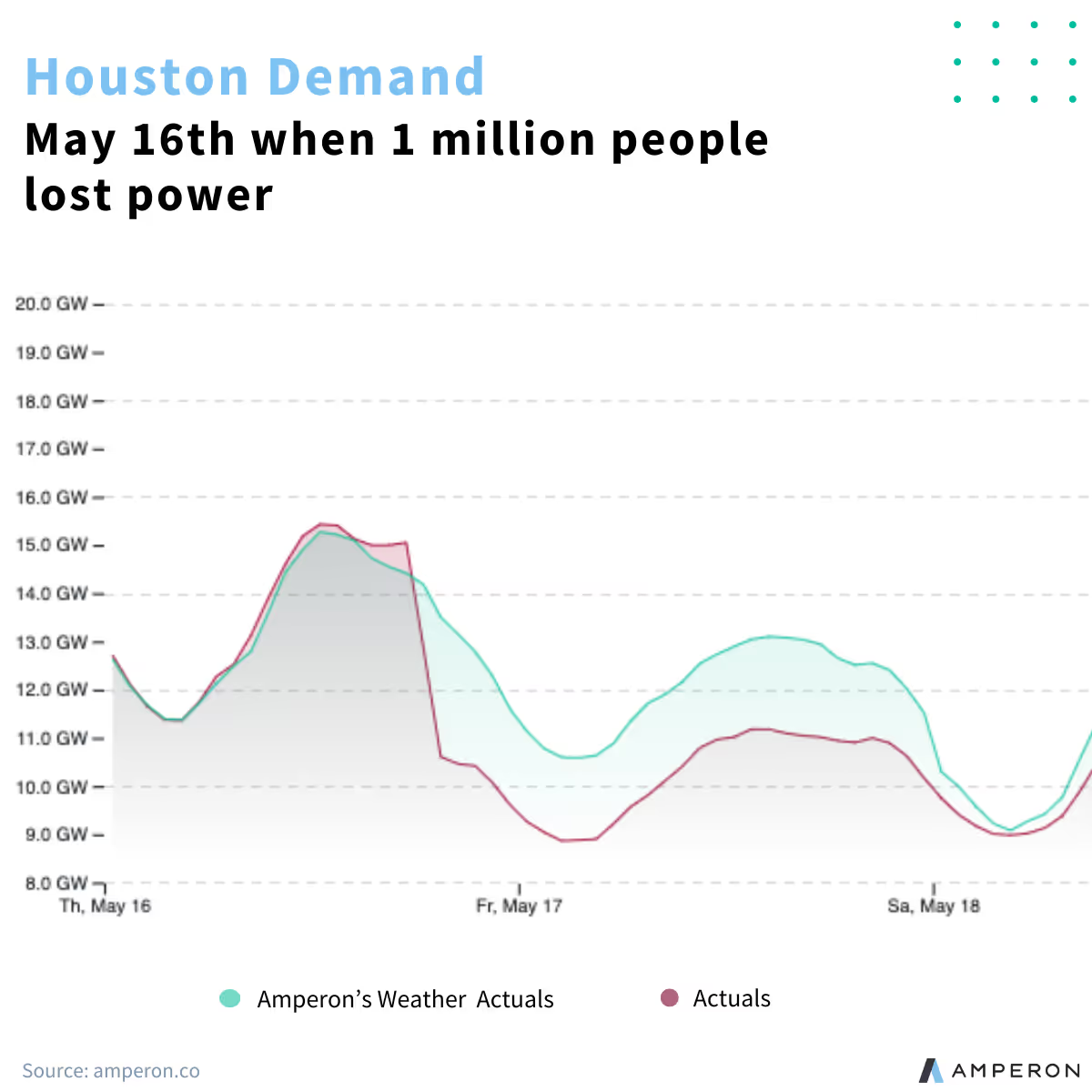

In the meantime, the burden of managing congestion risk is shifting from long-term contracts to short-term forecasts. With firm service now offering less financial protection, market participants will increasingly depend on short-term operational visibility to stay ahead of risk.

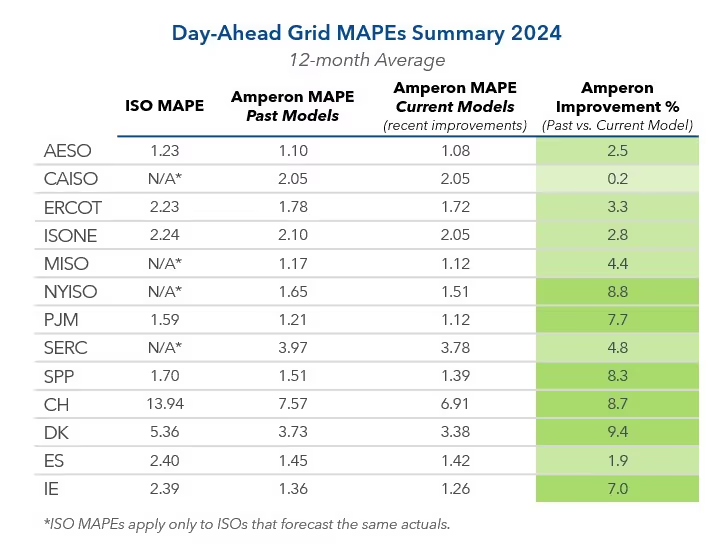

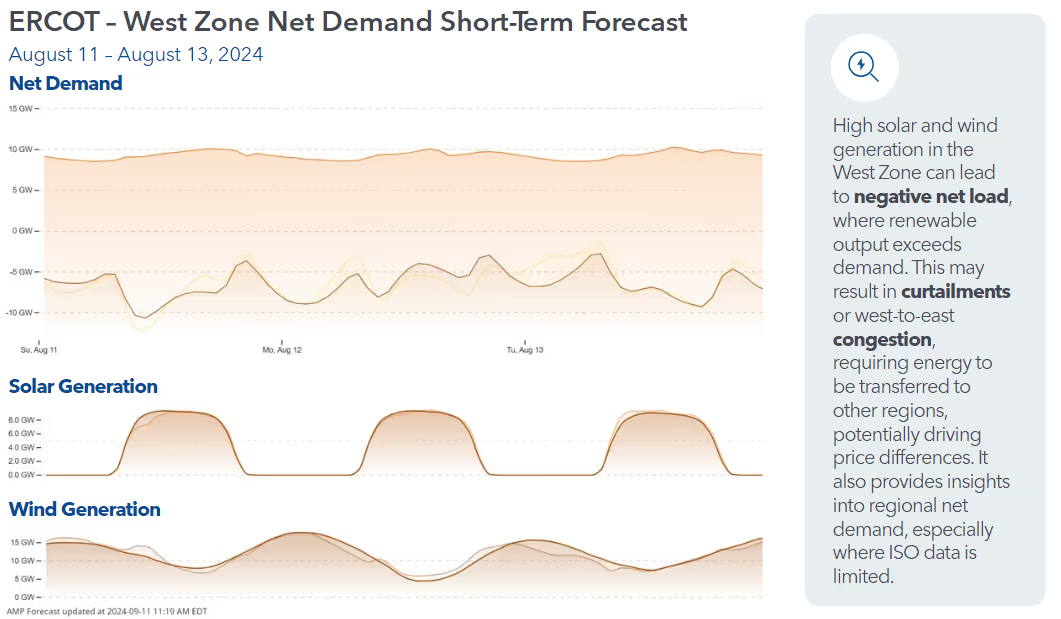

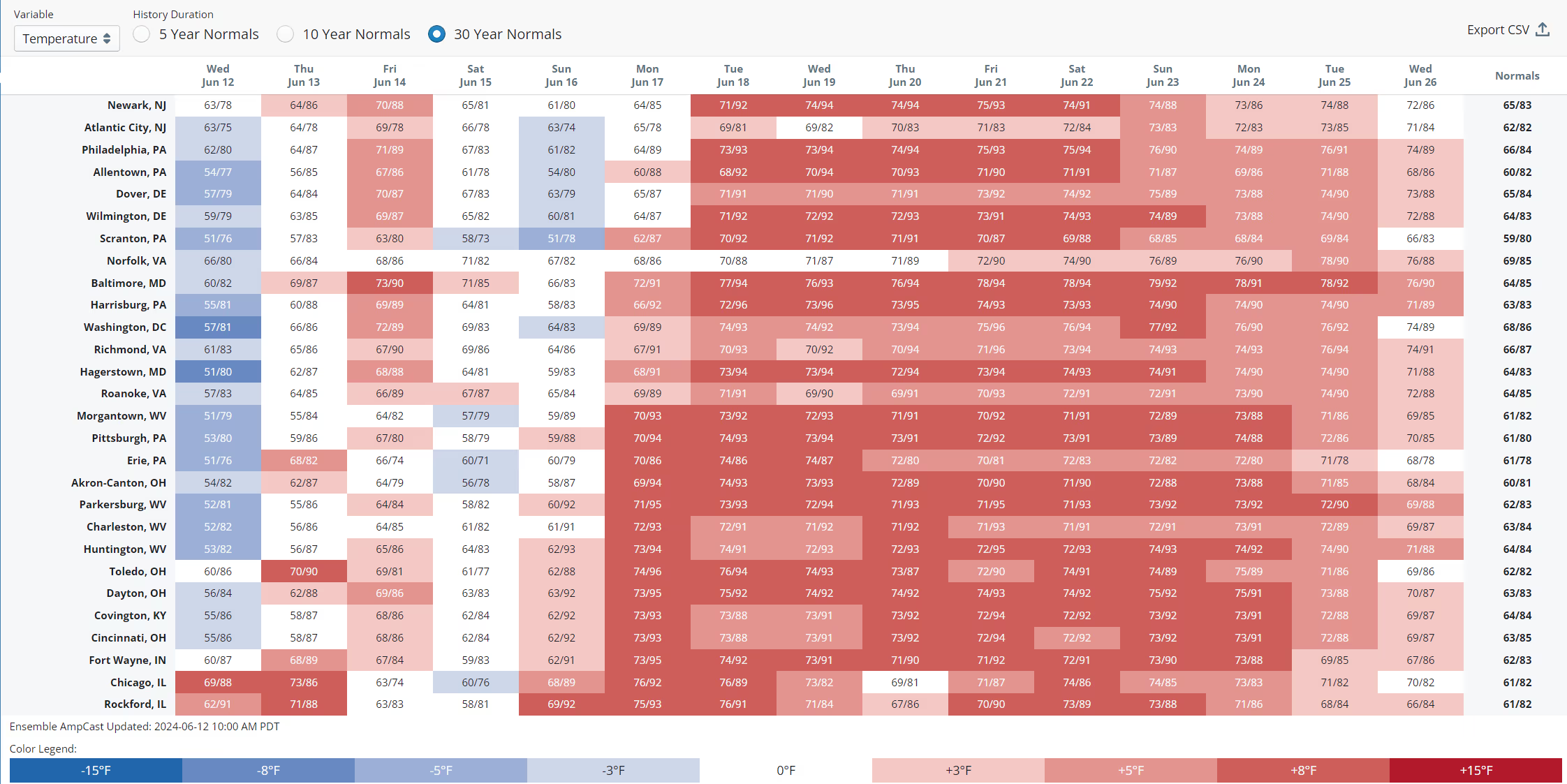

Amperon’s short-term demand forecasts help predict granular load patterns at the level of grid load zones or even individual meters, and our short-term renewable generation forecasts account for the effects of hyper-specific weather patterns on intermittent supply. Both will become more critical than ever before as traders attempt to avoid transmission basis risk.

Contact us to discuss your options with an Amperon representative.

*NOTE: On August 29, 2025, the Federal Energy Regulatory Commission formally approved tariff revisions allowing PacifiCorp and Portland General Electric to join EDAM, while also signing off on CAISO’s proposed congestion revenue allocation framework. Importantly, FERC confirmed that the so-called “transitional fix” for congestion revenues—intended to share some funds with neighboring balancing authorities—has no sunset date. This means the temporary framework could remain in place indefinitely unless stakeholders and CAISO agree on further reforms. While CAISO has committed to launching a redesign process within 12–24 months of go-live, FERC’s decision underscores that market participants cannot count on a firm expiration for the current rules, leaving ongoing uncertainty around how congestion risk will ultimately be managed.

[1] FTRs entitle the holder to receive compensation for congestion costs while transmitting electricity.

[2] In competitive electricity markets, actual power flows are determined by market optimization via market-based dispatch.

[3] The race to bring water to a growing Los Angeles in the early 20th century sparked much debate—and some bombings—over who held the rights.

.svg)

%20(3).png)

%20(2).png)

%20(1).png)

.png)

.avif)

.avif)

.avif)

.avif)

.avif)

%20(15).avif)

.avif)

%20(10).avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)