A rapid rise in renewable energy curtailment is threatening generator profits and data center power availability.

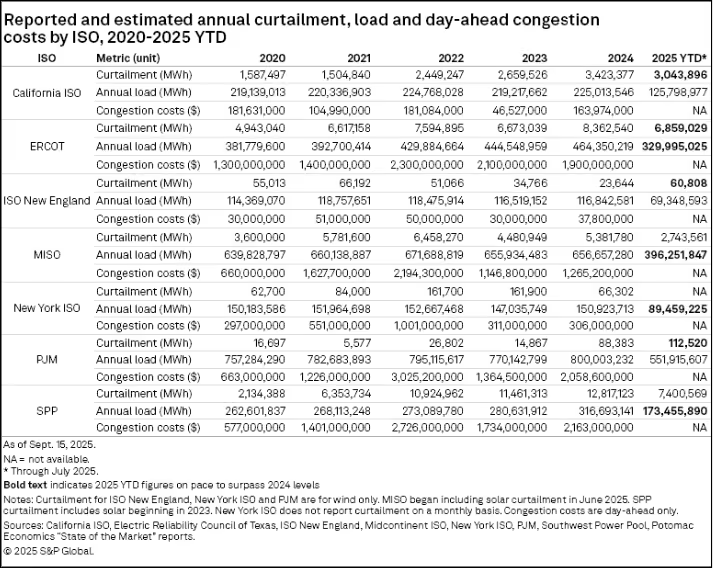

In 2024, four of the seven US ISOs set annual records for curtailed renewable energy—and 2025 is breaking those records again.

In SPP, for example, curtailment has increased sixfold since 2020. Even PJM, historically a low-curtailment region, saw a sixfold increase in 2024, and 2025 has already exceeded that.

Why Curtailment Is Surging

Much has been said about data center load growth, backlogged interconnection queues, and uncertain power plant retirements, but there is a silent bottleneck driving the majority of curtailments: transmission.

Without sufficient transmission, renewable generation can’t reach the places that need it most. Millions of MWh of clean energy are being left on the table as a result.

Curtailment isn’t just a waste of power. It’s a direct hit to generator revenue and a growing concern for utilities and consumers alike. When grid operators order curtailments to maintain reliability, generators lose the ability to sell power—or in some cases, they may forced to pay to generate. Meanwhile, data centers, hungry for new clean power, can’t use curtailed energy.

Transmission Investment Is Rising—But Is It Enough?

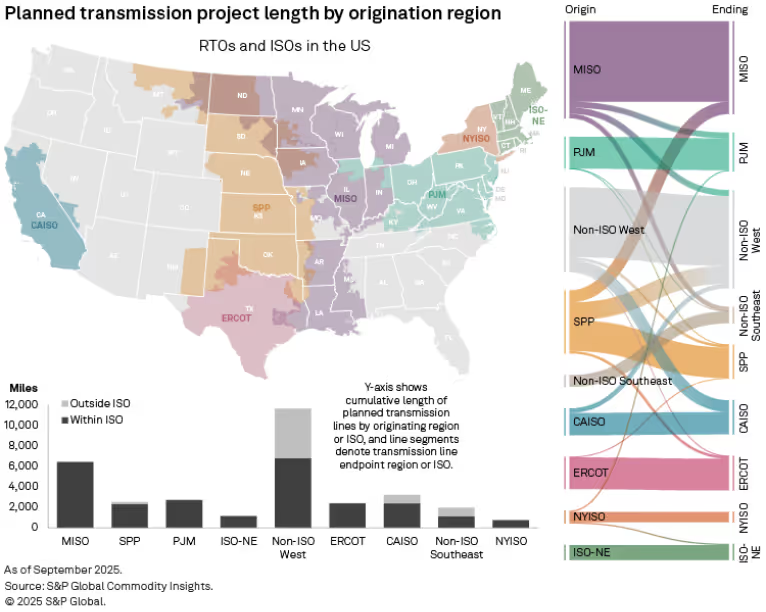

Utilities and grid operators are starting to respond. Utility T&D capital expenditure is projected to reach $84.9 billion in 2025, up $12 billion from 2024. Planned transmission projects have increased 25% year-over-year, with roughly 26,000 miles of lines in development.

Despite these efforts, the pace of transmission development still lags behind the growth in renewable generation and load. And federal energy policy reversals—like the DOE’s cancellation of $7.6 billion in grid modernization contracts—have added uncertainty to long-term planning.

Additionally, most new transmission occurs within ISO territories, rarely crossing boundaries due to regulatory and planning hurdles. The non-ISO West is a notable exception, but the broader outlook for trans-regional transmission remains uncertain.

Meanwhile, renewable energy penetration continues to climb, exacerbating curtailment risks. Let’s break down what’s happening across the most-affected ISOs and what it means for future curtailment risk.

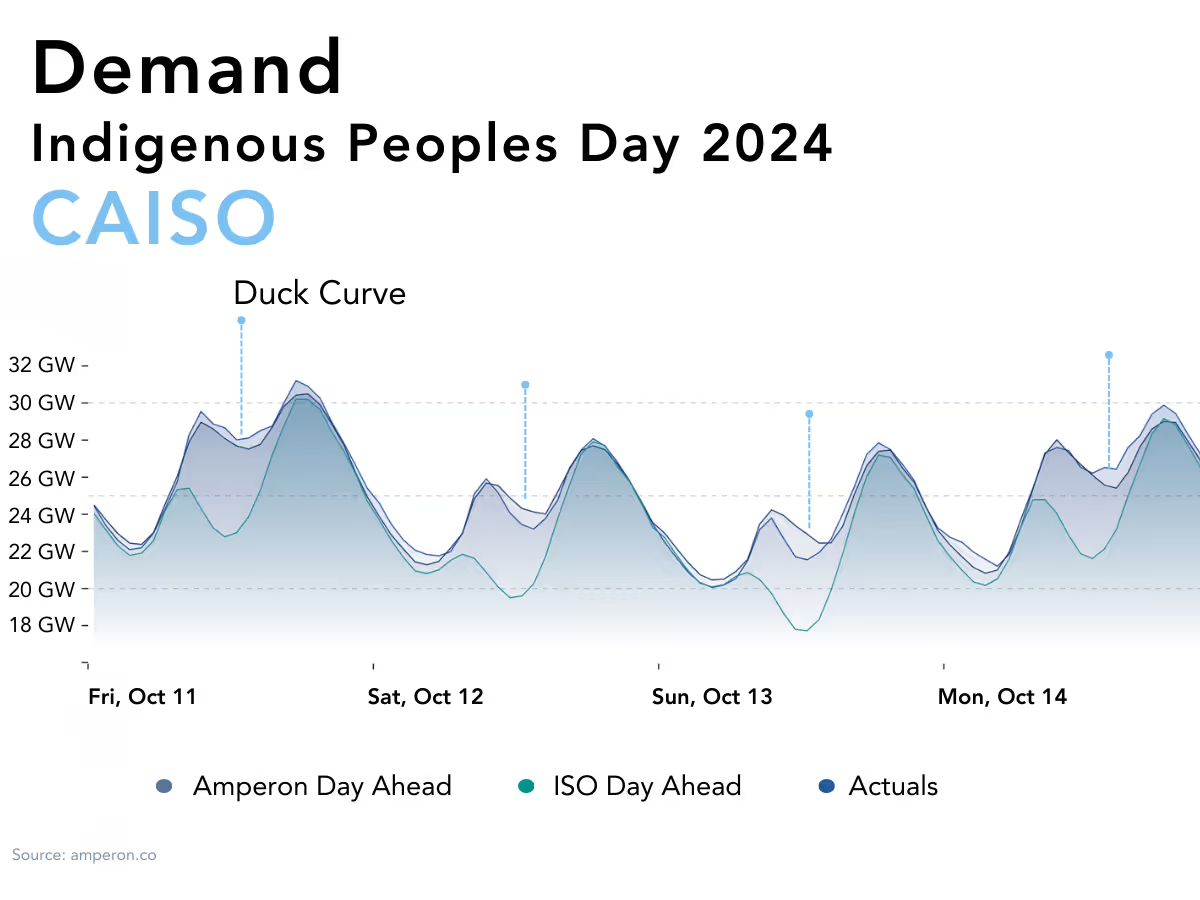

CAISO: Spring Curtailments and the SP15 Bottleneck

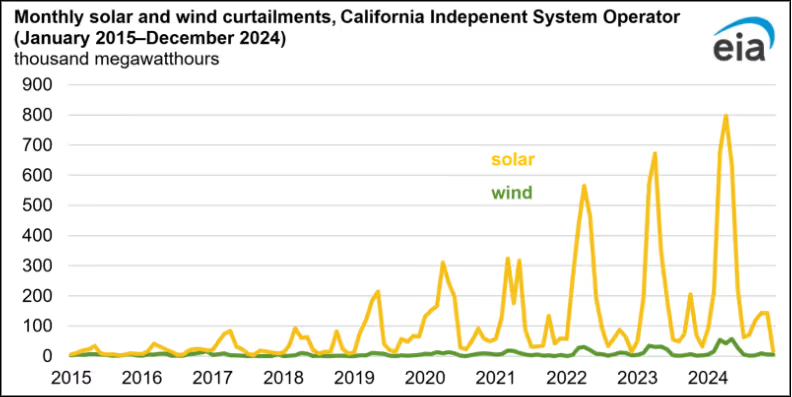

California’s solar boom has created a paradox: abundant midday generation that the grid can’t always use. In 2024, CAISO curtailed 3.4 million MWh of solar and wind, a 29% increase from 2023. Solar accounted for 93% of all curtailed energy.

The problem is especially acute in shoulder seasons (spring and fall), when mild temperatures reduce demand for heating and cooling. Most solar capacity is concentrated in Southern California’s SP15 zone, but demand is higher in the north. This creates northbound transmission congestion, driving extreme negative pricing events even after curtailment.

CAISO is responding with several strategies:

- Battery storage capacity grew 45% in 2024, reaching 11.6 GW.

- Trading excess energy via the Western Energy Imbalance Market (WEIM) avoided 274,000 MWh of curtailments in 2024.

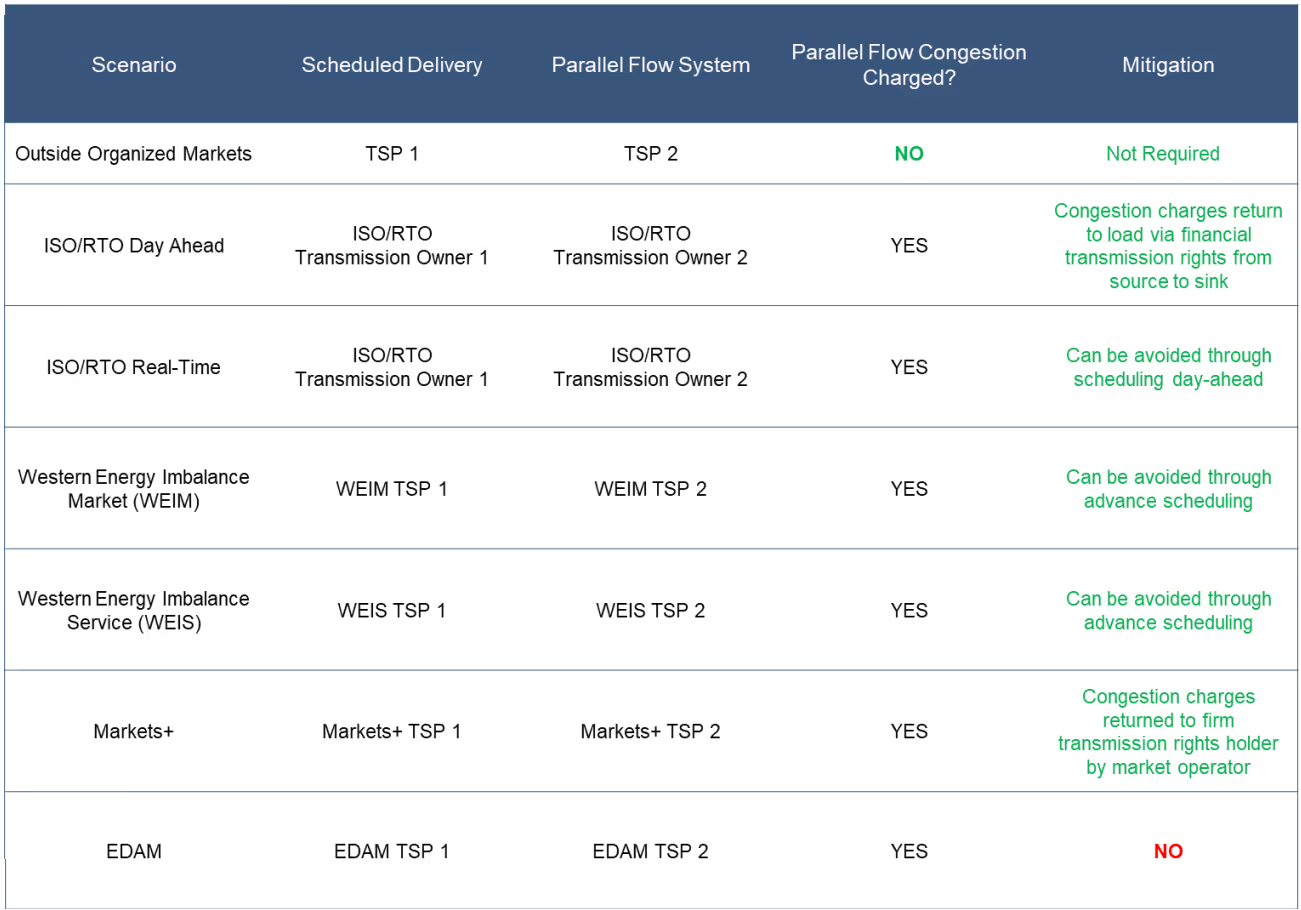

- Transmission upgrades are underway, and the Extended Day-Ahead Market (EDAM) is expected to launch in 2026—bringing other potential consequences for market participants.

CAISO Curtailment Outlook: Despite progress, CAISO’s curtailment risk remains high, especially in spring. Batteries help, but long-duration storage and transmission expansion are essential to fully unlock solar value.

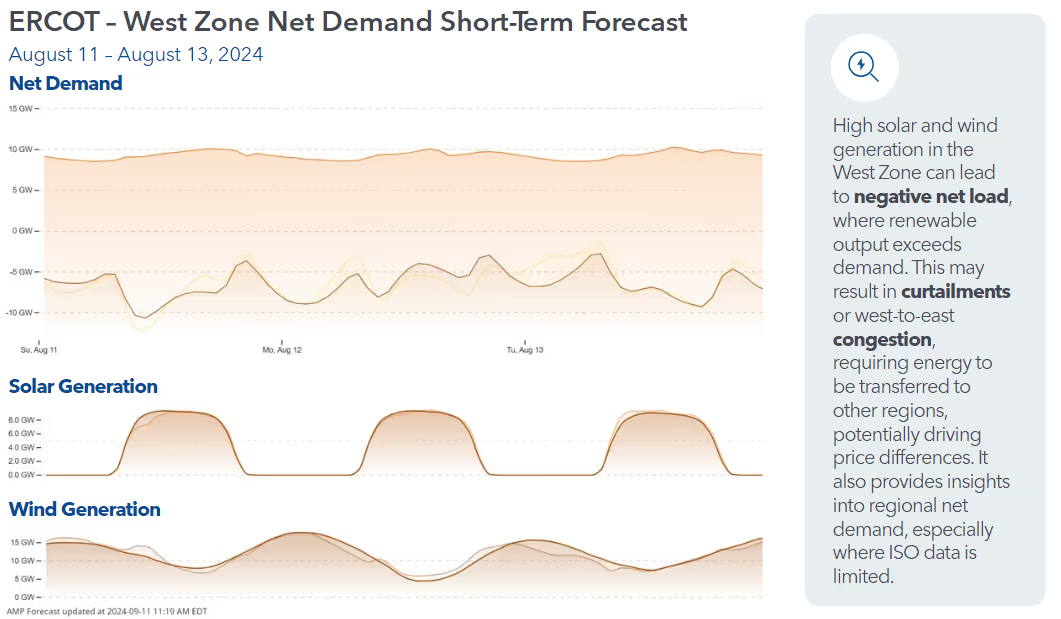

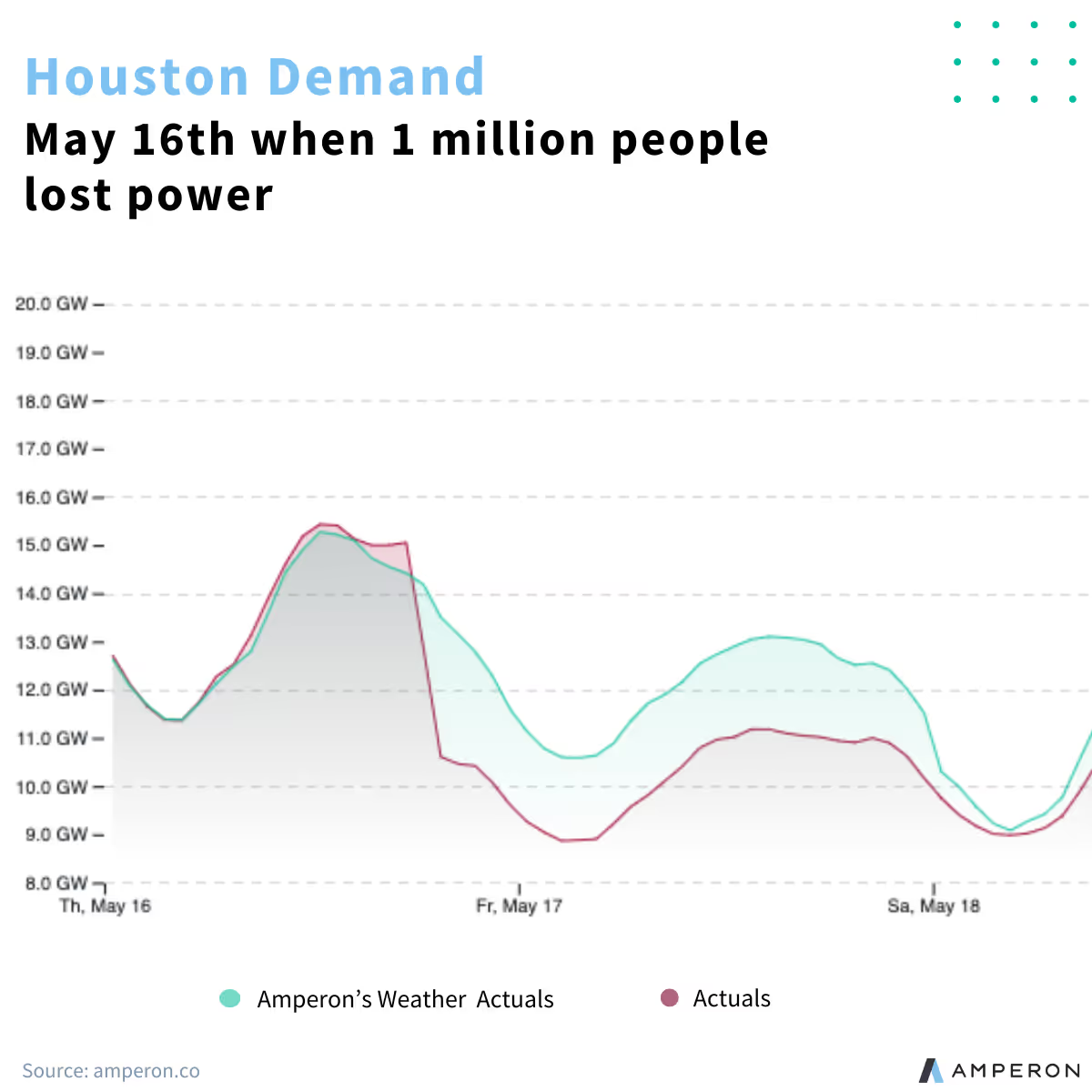

ERCOT: Intractable Curtailment in the West

Texas is experiencing explosive load growth driven by data centers, crypto mining, and electrification. Yet curtailment is surging, with over 8 TWh of wind and solar curtailed in 2024.

The West and Panhandle zones are the hardest hit. These regions generate more renewable energy than the transmission system can export eastward. Curtailment averages 1.2 GW per hour, equivalent to shutting down dozens of solar and wind facilities.

ERCOT’s response includes:

- Permian Basin Reliability Plan, which could introduce a new 765-kV transmission backbone.

- Natural gas plant applications are rising to meet peak demand.

- Battery and hybrid installations are growing, but not fast enough to offset curtailment losses.

ERCOT Curtailment Outlook: ERCOT’s curtailment risk is structural. Without a major transmission buildout, especially in West Texas, curtailments will continue to erode generator profits.

PJM: A Sudden Spike and a $6.7 Billion Transmission Plan

Historically, PJM has seen minimal curtailment, but in 2024, curtailments jumped nearly sixfold compared to 2023—and 2025 has already surpassed that record.

The surge is driven by:

- Accelerated load growth, especially from data centers and electrification.

- Retirement of dispatchable generation, shifting the grid toward more intermittent resources.

In response, PJM approved a $6.7 billion transmission expansion plan, including:

- A $4.6 billion 765-kV backbone connecting West Virginia, Maryland, and Virginia.

- Additional upgrades in Indiana, Ohio, and Virginia.

- Projects designed to enable coal plant retirements and support regional power transfers.

PJM Curtailment Outlook: PJM is investing aggressively in transmission, which should help mitigate future curtailment. However, the pace of renewable growth and interconnection requests means forecasting and risk management remain critical.

SPP: Large-Scale Wind Curtailment and a Historic Transmission Investment

SPP’s curtailment is almost entirely wind-driven. From 2020 to 2024, wind curtailments increased sixfold, reflecting both rising wind capacity and transmission bottlenecks.

In 2024, SPP approved a record-breaking $7.7 billion transmission plan, including:

- 2,333 miles of new transmission and 495 miles of rebuilds.

- A 765-kV line from Texas to New Mexico to support remote load centers.

- Projects to boost north-south transfer capacity by 1.5 GW, improving winter storm resiliency.

SPP Curtailment Outlook: SPP’s aggressive transmission buildout is promising. If executed on schedule, it could significantly reduce curtailment risk and improve grid flexibility. Still, seasonal wind variability and long lead times for transmission mean asset owners must stay vigilant.

How to Mitigate Curtailment Risk

Waiting for transmission upgrades isn’t a strategy—it’s a gamble. Asset owners must take proactive steps to understand and manage curtailment risk.

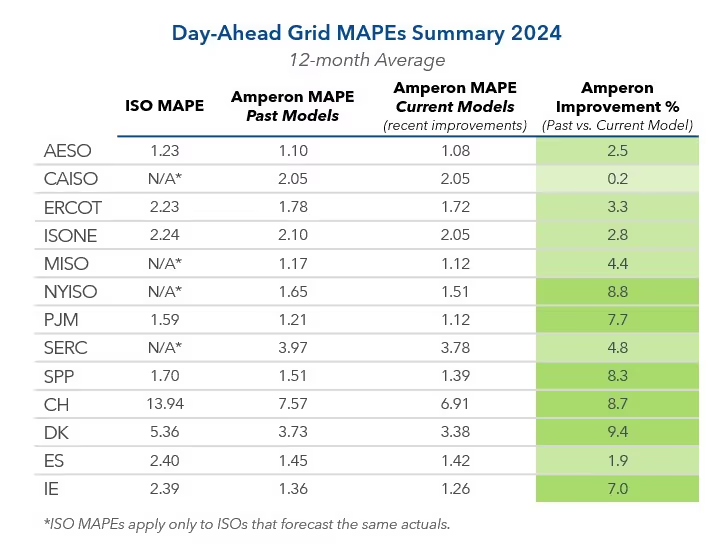

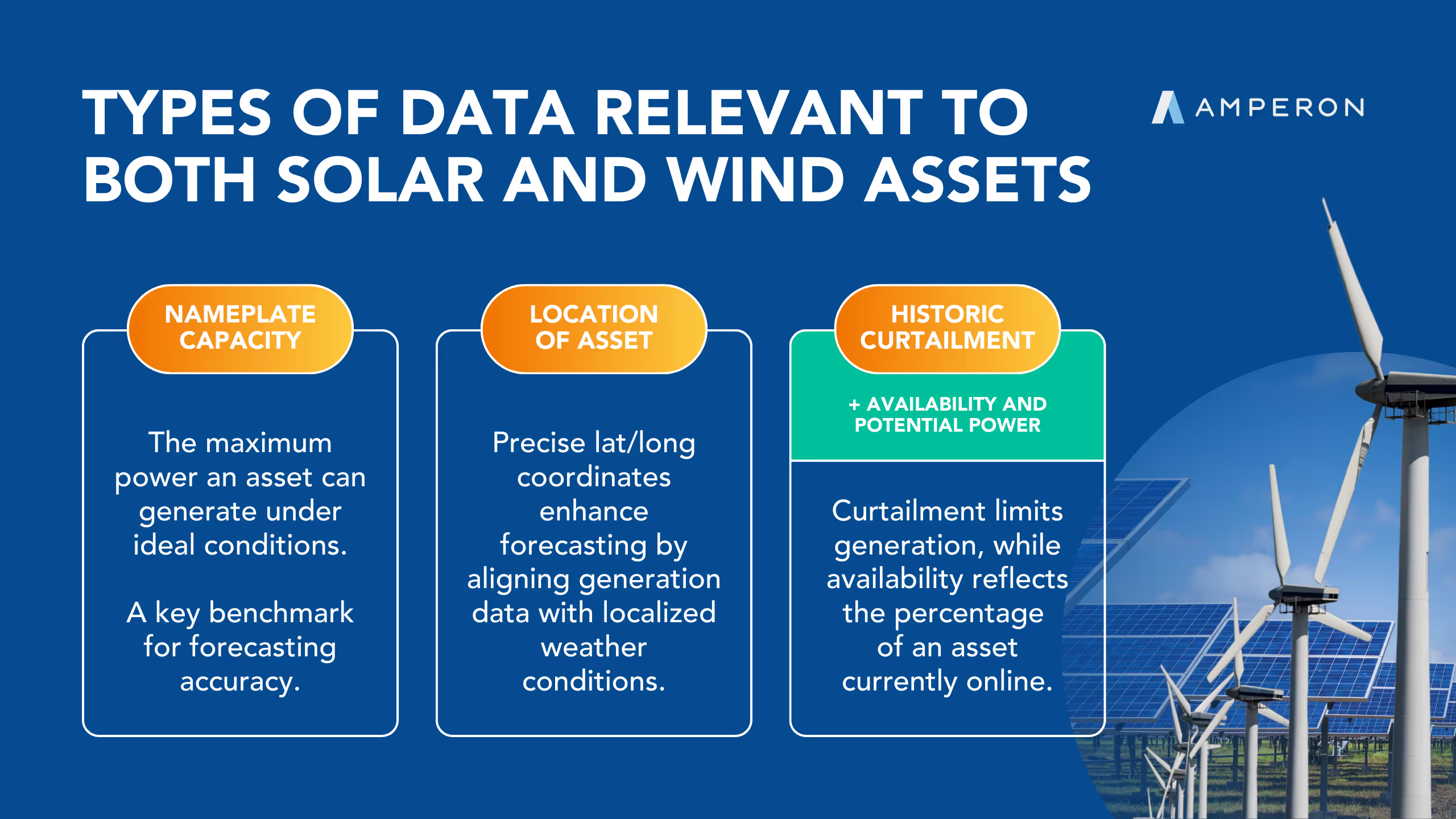

Amperon’s Sub-Hourly and Short-Term solar and wind generation forecasts incorporate curtailment risk, asset-specific metadata, and localized weather inputs. Our hybrid forecasting approach blends physics-based and machine learning models to deliver:

- Accurate forecasts, even during curtailment events

- Battery dispatch optimization

- Revenue protection through better market bidding

Download our white paper to explore detailed risk mitigation strategies for congestion, curtailment, and negative pricing.

.svg)

%20(3).png)

%20(2).png)

%20(1).png)

.png)

.avif)

.avif)

.avif)

.avif)

.avif)

%20(15).avif)

.avif)

%20(10).avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)