The bitcoin mining company Riot Blockchain made headlines this summer when they announced making $9.5 million, not from mining bitcoin, but in energy credits from shutting down their operations. While this practice might be new for bitcoin companies, this is a well-known practice for C&I facilities: Shutting down production or shifting giant commercial load can save more money than running operations as normal.

Major grocery stores, big box companies, manufacturing, refineries, schools, sports stadiums…do some form of this. But for those that aren’t a large C&I or a registered CLR, you can still take a proactive approach to energy management.

We’ll break down how with the right tools, buying power in the wholesale market can reduce energy costs. It’s not only a financial win for a company but also improves grid resiliency and ensures more renewable generation is built for everyone.

PROCURING ENERGY

C&I customers have the option to buy and sell energy on the wholesale market. In ERCOT, you need to register as a Controllable Load Resource (CLR), but every market has some version of this.

Another option for C&I companies is to buy 5- to 20-year PPAs to cover their usage. These agreements guarantee the C&I will have enough energy to operate by building out more generation. If they opt for a renewable PPA, it also spurs wind or solar production on the grid and can help state and local governments reach renewable goals. A lot of these agreements come with terms from the ISO that require them to curtail load when called upon, usually when demand on the grid is strained.

Either option lets C&I customers sell back extra energy at the wholesale price if they decide to curtail load.

KNOW YOUR ENERGY DEMAND

The most important part of managing risk on the wholesale market is knowing how much demand your book will use for any given hour of the day. Key things to pay attention to are:

- Know the hourly short-term and long-term forecast of your operation so you can hedge your load efficiently

- Day-ahead and real-time settlement prices to show your operation’s exposure and energy profit/loss

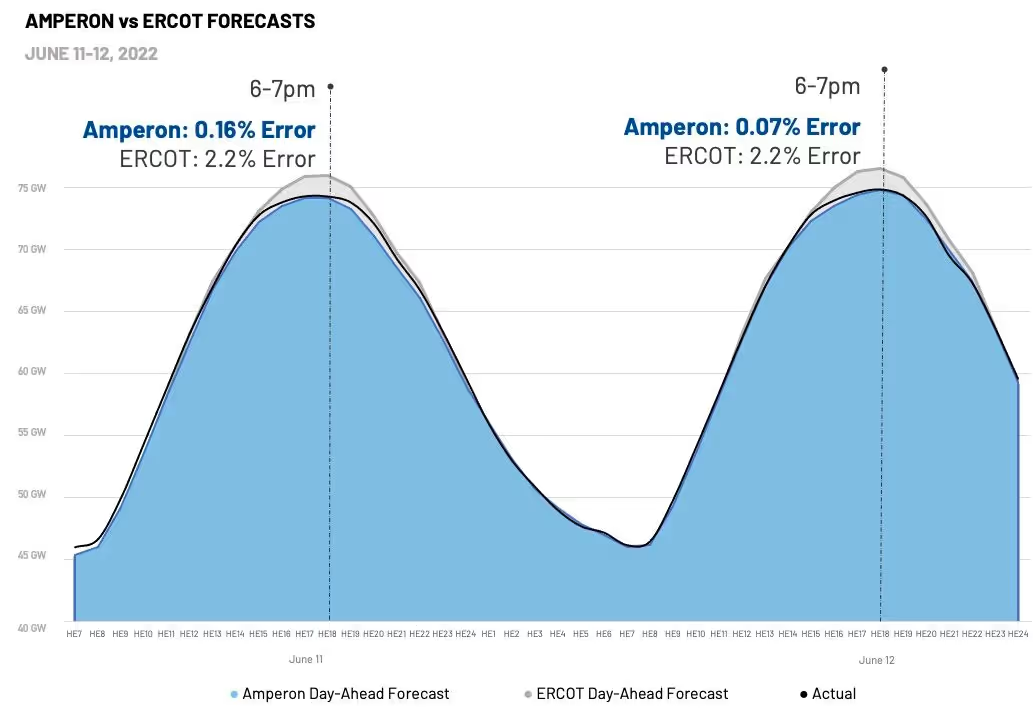

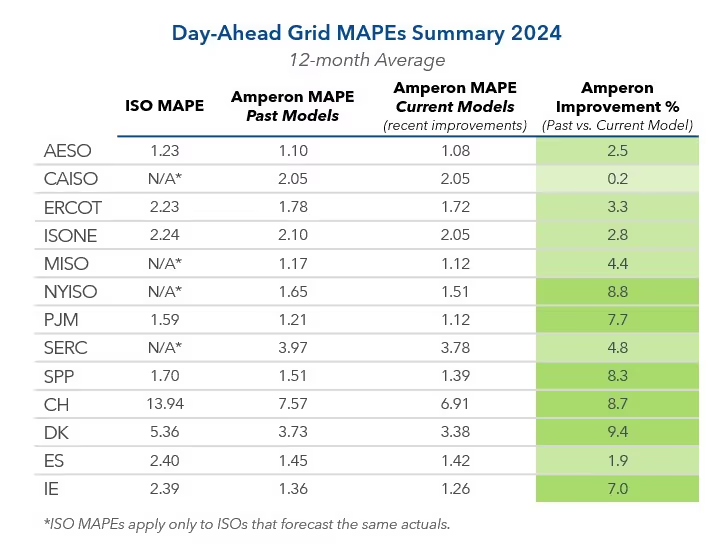

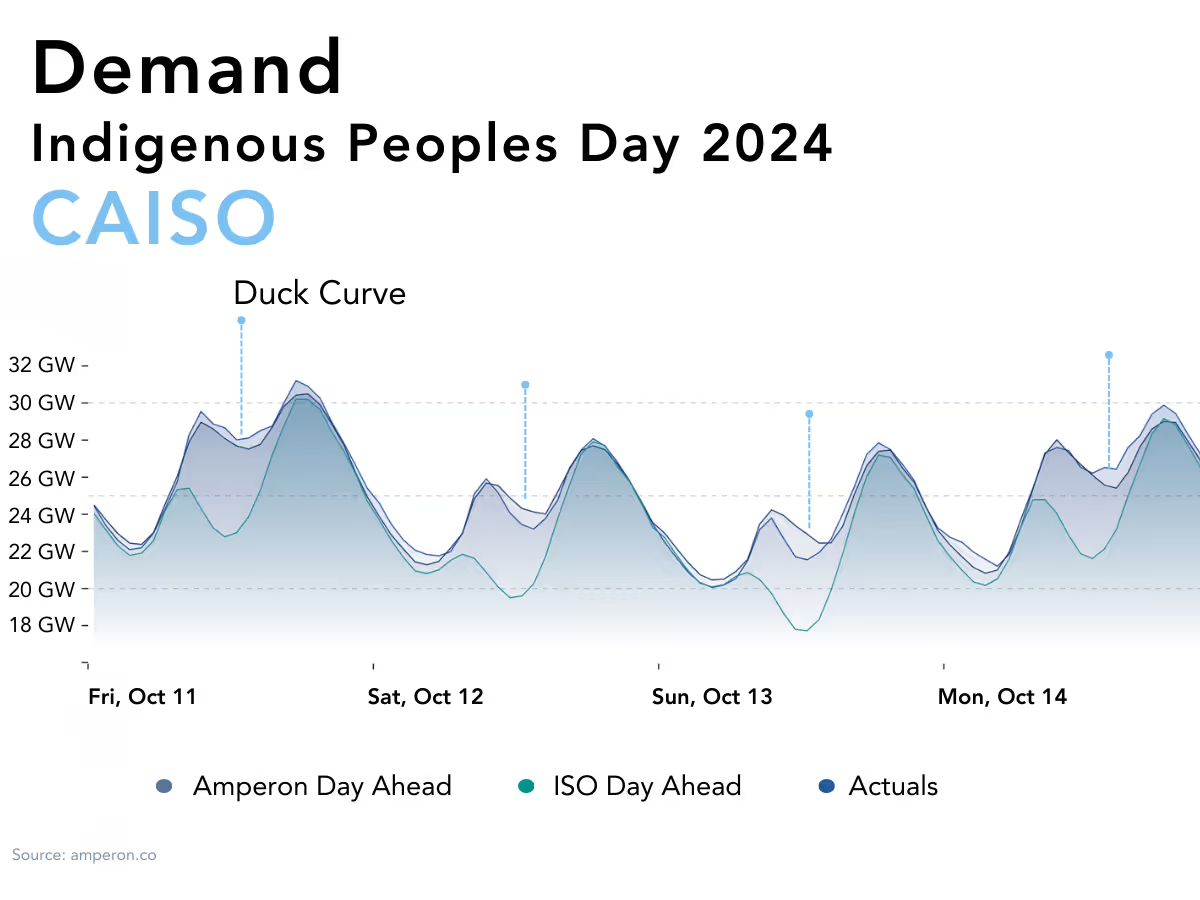

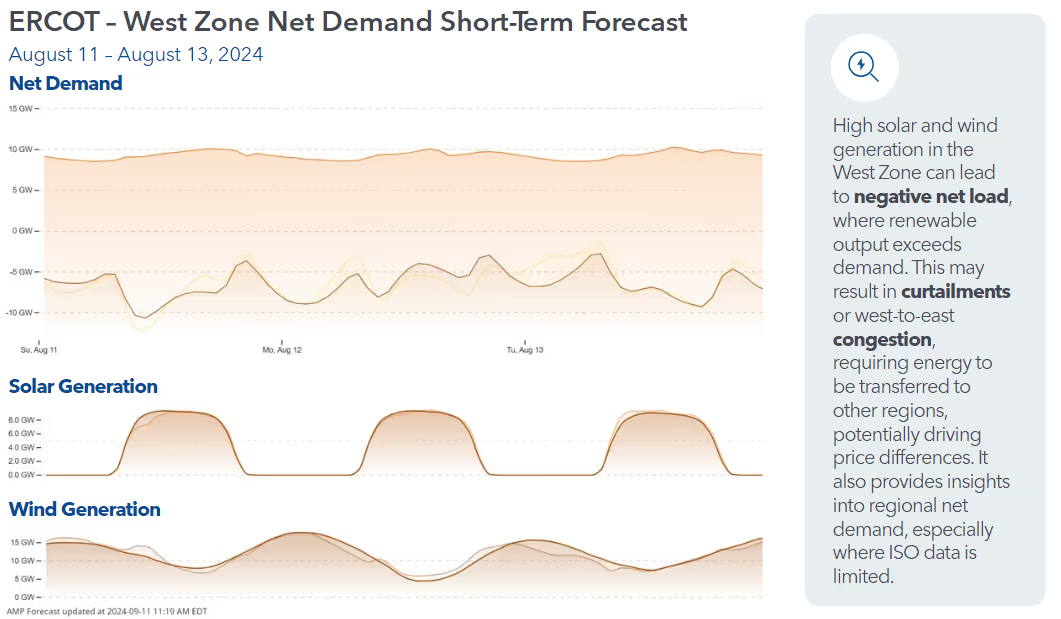

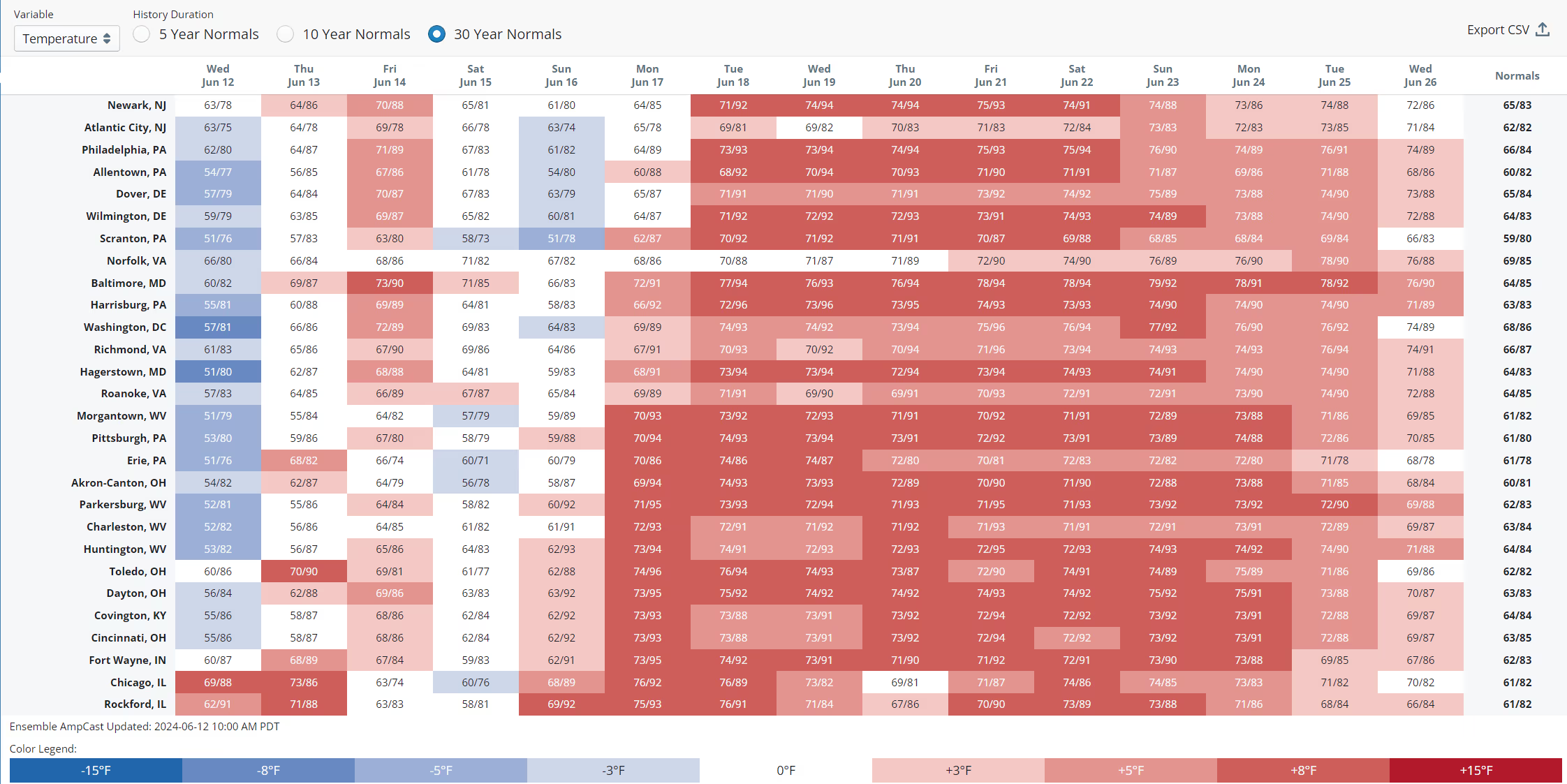

For some markets, like ERCOT, summer is the riskiest season because of droughts, heat waves or hurricanes. But a lot of demand forecasts are inadequate when it comes to extreme weather events. Earlier this summer when ERCOT had one of its first record demand days on June 12, Amperon’s forecasts had an accuracy of less than .2% for those highest-peak hours while ERCOT was at 2.2%.

While we don’t know what ERCOT uses for their forecasts, we have noticed they do fine on regular days and are less accurate in unusual situations. With more extreme weather events happening, it’s important your demand-forecast models use an ensemble of accurate weather models that cope well with these extreme scenarios so you have the most best information available to manage your risk.

CURTAIL LOAD DURING HIGH-PRICED EVENTS

Each summer, a critical component of your annual electric bill is the transmission cost which is partly based on how much each customer contributed to the total peak load of the electric grid. The larger your load contribution to that peak, the greater your monthly charge for the whole year will be.

In calculating transmission charges, utilities look at the single 15-minute period in each of four months – June, July, August and September – when demand was the highest on the grid. Each ISO calls this program something different: ERCOT is 4CP; PJM is 5CP/NSPL; ISONE and NYISO are 1CP.

These charges can account for as much as 30% of the total energy bill. So if you consume less power during these hours, you can significantly cut your total electric bill for the coming year.

But how much can this save C&I?

Customers can save between $50-60k on transmission charges for every MW curtailed (depending on locations), which can be millions of dollars annually.

Curtailing load can be as easy as turning off or dimming lights, increasing or decreasing the temperature slightly (by 1.5 degrees), setting refrigeration or other appliances in low mode, switching to an off-site generator or going to the extreme and shutting down all non-essential operations.

HEDGING AT THE RIGHT TIME

Curtailing load during CP events is one way to save on transmission charges. But C&Is can also make money while hedging efficiently during high-priced times.

First things first, you need to know your meter demand to hedge efficiently.

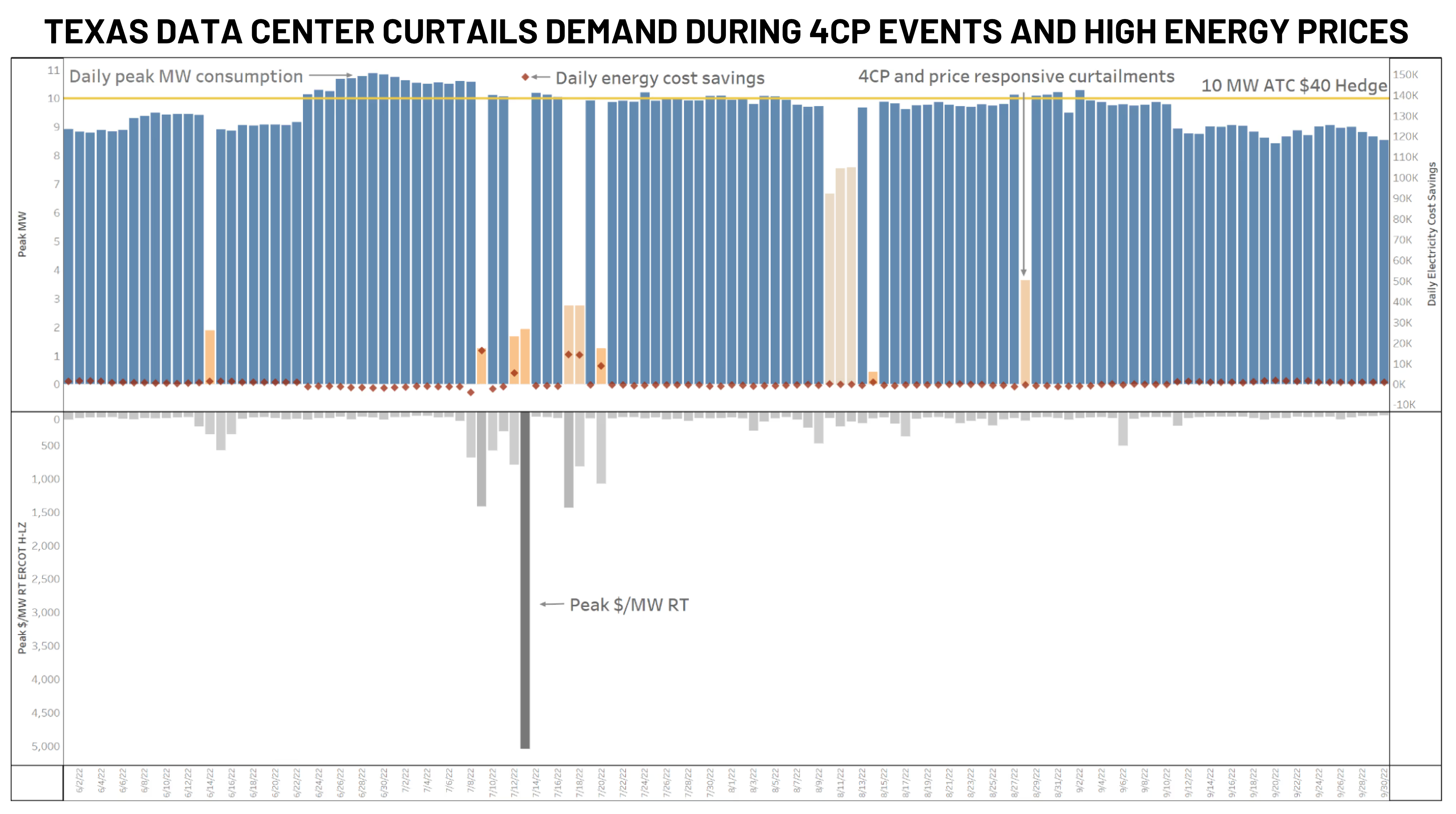

For example, the 10 MW data center below purchased a CAL22’ ATC strip at $40 to hedge their 2022 consumption. During the summer, ERCOT’s real-time prices met or exceeded $500/MWh for over 1800 hours. This data center seized the opportunity to reduce its energy spend by more than $200k by shutting down for only 18 of those hours and selling its hedge back into the market.

Additionally, the data center curtailed its usage during peak grid events to reduce transmission costs. Successfully reducing consumption during 4CP events can reduce transmission costs by up to $60k/MW depending on the utility and site.

IMPROVING GRID RESILIENCY AND SUSTAINABILITY WITH LOAD CURTAILMENT

Just how much energy can big C&I companies curtail? In July, Riot curtailed more than 11,000-megawatt hours, which is enough to power 13,000 average homes for one month. And that’s just one company out of the thousands of C&Is in ERCOT.

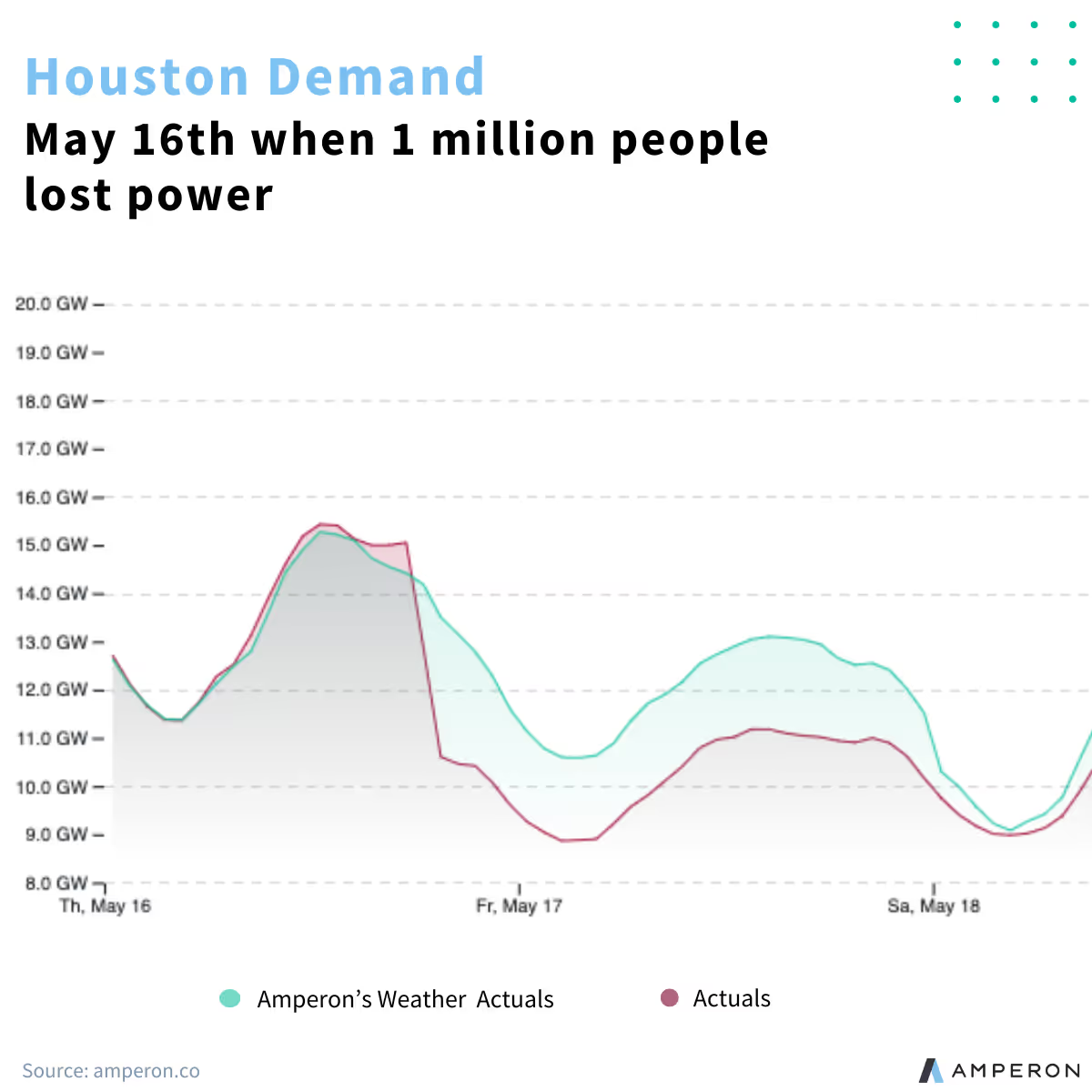

Encouraging companies to shift usage during high-peak times vastly reduces the strain on the grid and prevents blackouts. If the weather forecast is hotter than predicted or a transmission issue is causing constraints on the grid, having C&I curtail load frees up energy for essential activities.

The more CLRs there are, or if the process was democratized, the more people will be incentivized to shift usage and really make a difference in how the grid operates. We’d be able to:

- Keep prices low: When the grid is overloaded, this drives up prices. If companies aren’t hedged correctly, they pass those losses on to the end user.

- Rely less on fossil fuels: When demand outpaces supply, grid operators depend on coal-fueled peaker plants that can be turned on quickly. If companies, or even consumers, respond to high-priced events by shifting usage, then fewer fossil fuels would be used.

- Increase renewable generation: When a new bitcoin farm or data center or any giant C&I joins the grid, it means new generation needs to be built. Oftentimes, companies elect to build renewable generation to offset their usage. If none of them were here, there would be less renewable generation.

DEMAND FORECAST SOLUTION FOR C&I

A lot of these practices depend on accurate forecasts – which are becoming harder to predict.

Amperon’s AI-powered energy solutions were built for the increasingly complex and dynamic power markets. We combine energy expertise and machine learning data science to give C&I customers the proper tools to reduce energy costs. Those tools include:

- Accurate demand forecasts: Amperon takes your underlying meter-level data to provide short (15-day) and long (5-year) term forecasts. Once you know your demand, then you can hedge efficiently.

- CP Alerts: Amperon offers Coincident Peak Alerts for ERCOT (4CP), PJM (5CP/NSPL), NYISO, and ISO-NE so you will be aware of when to curtail load to save on transmission charges.

- Scheduling: Our scheduling tool communicates directly with your retail energy provider to submit the correct day-ahead bids using our load forecasts.

The energy transition is making managing risk increasingly difficult. But with the right tools in place, your business can reduce costs and take a more active approach to energy management.

.svg)

%20(3).png)

%20(2).png)

%20(1).png)

.png)

.avif)

.avif)

.avif)

.avif)

.avif)

%20(15).avif)

.avif)

%20(10).avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)